Cratoflow

An automated bookkeeping platform to take charge of your business finances

Your business has finally started making big sales, but your money management skills peak at skipping that add-on of fries with your burger. (#financialliteracy)

Unfortunately, hiring and training a bookkeeper is expensive, and there’s still no guarantee that they’ll keep your finances as current as you need them to be.

What if there was a way to maintain a real-time, accurate picture of your business’s financial health without hiring another person?

Meet Cratoflow.

TL;DR

Overview

Cratoflow is an automated bookkeeping platform that handles all your transactions for a real-time overview of your business’s financial health.

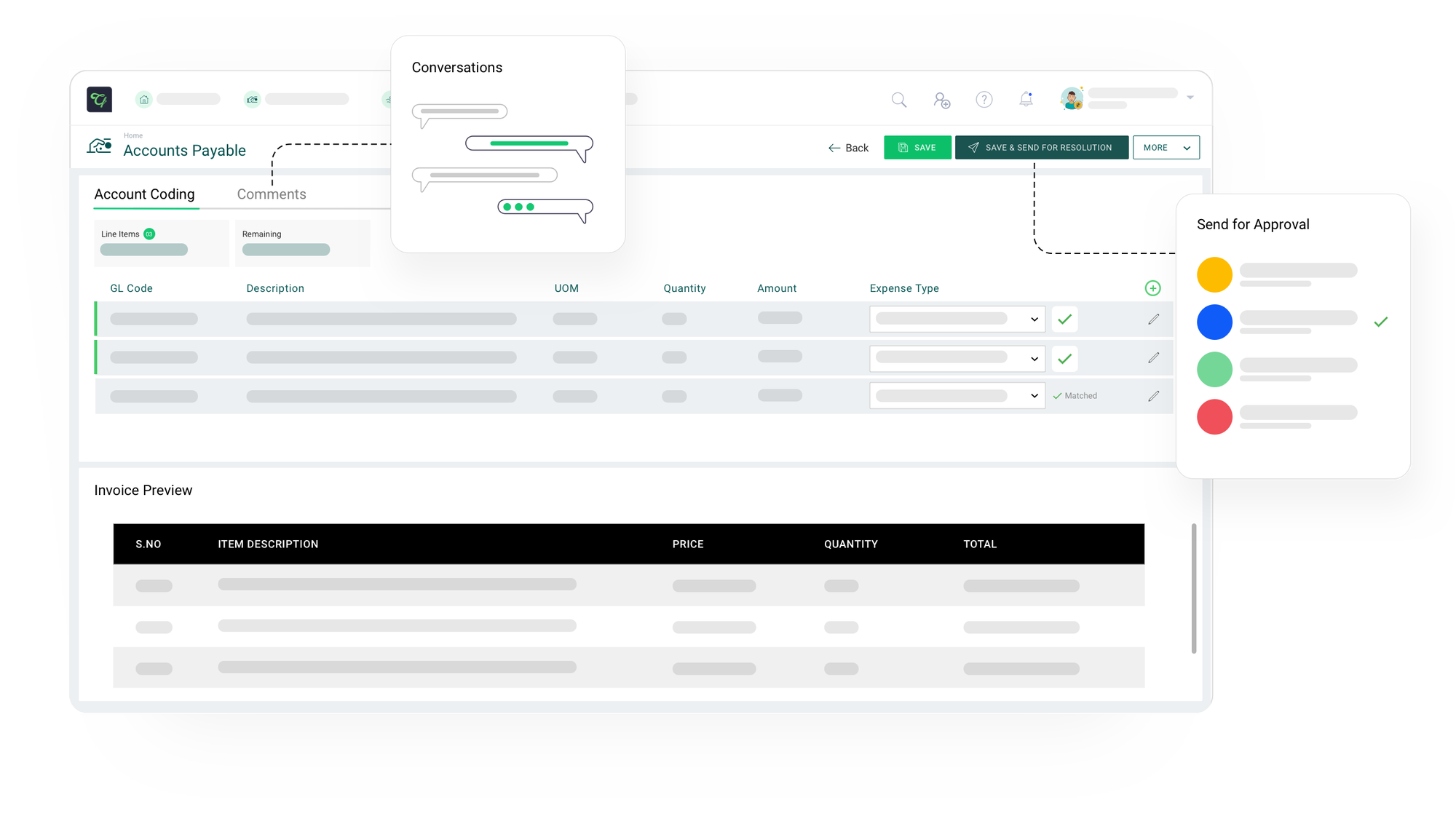

Cratoflow’s Cratobot feature helps get your accounts in order by systematically separating each transaction by category and assigning it an account general ledger (GL) code.

You can then quickly export each entry into QuickBooks Online, so all of your transactions, incoming payments, and expenses are accounted for.

Best of all, the workflow’s interface and drag-and-drop capabilities make it a snap to resolve any accounting discrepancies without using multiple applications.

Streamline your accounts payable operations with GL coding by line item and QuickBooks integration.

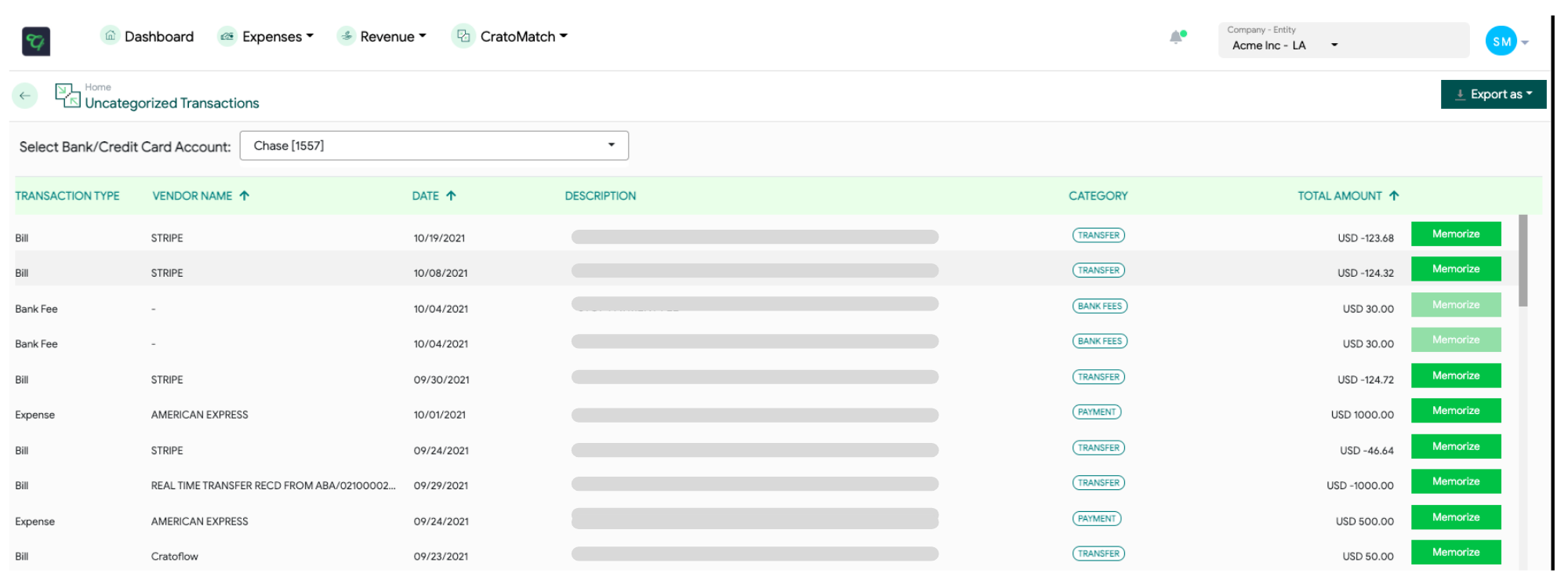

The Cratomatch function lets you finally reconcile bank deposits and withdrawals in real time.

Connect to your bank accounts and credit cards to instantly categorize deposits and withdrawals, as well as reconcile payment entries to invoices.

You’ll also be able to identify and flag questionable activity like repeated transactions, making it easy to prevent any fraudulent activity from being added to your books.

Get an overview of bank and credit card transactions automatically exported to QuickBooks Online.

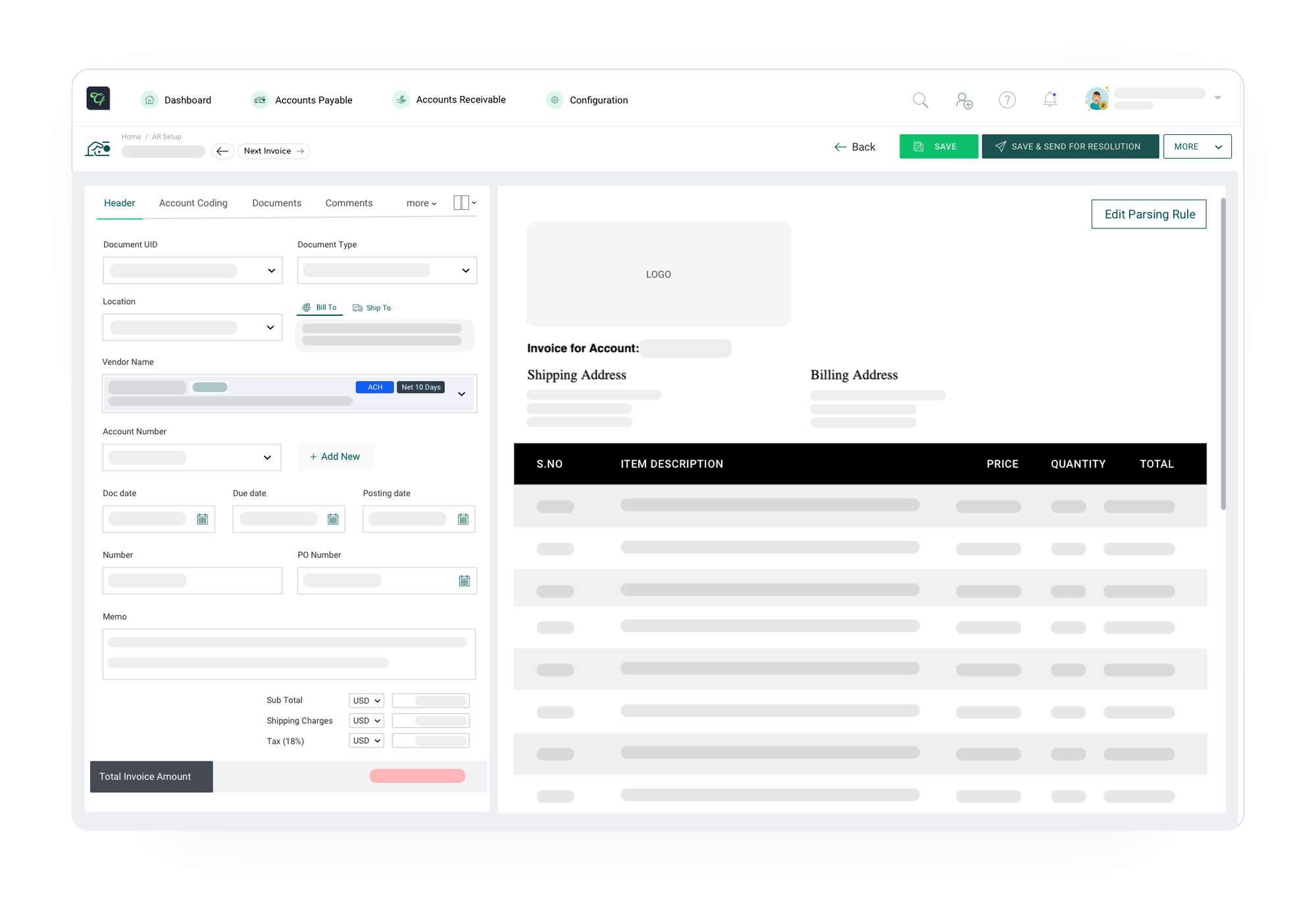

Cratoflow simplifies the daily sales verification process by letting you sync your point of sale system or use a built-in template to upload sales data.

You can also set up automated billing to ensure you always send accurate invoices on time, instead of having payments delayed for late submissions.

Then, Cratoflow will record the cash receipts once payments are made, verifying whether the money was received for the invoice submitted.

Keep track of outstanding invoices and send automated payments on schedule.

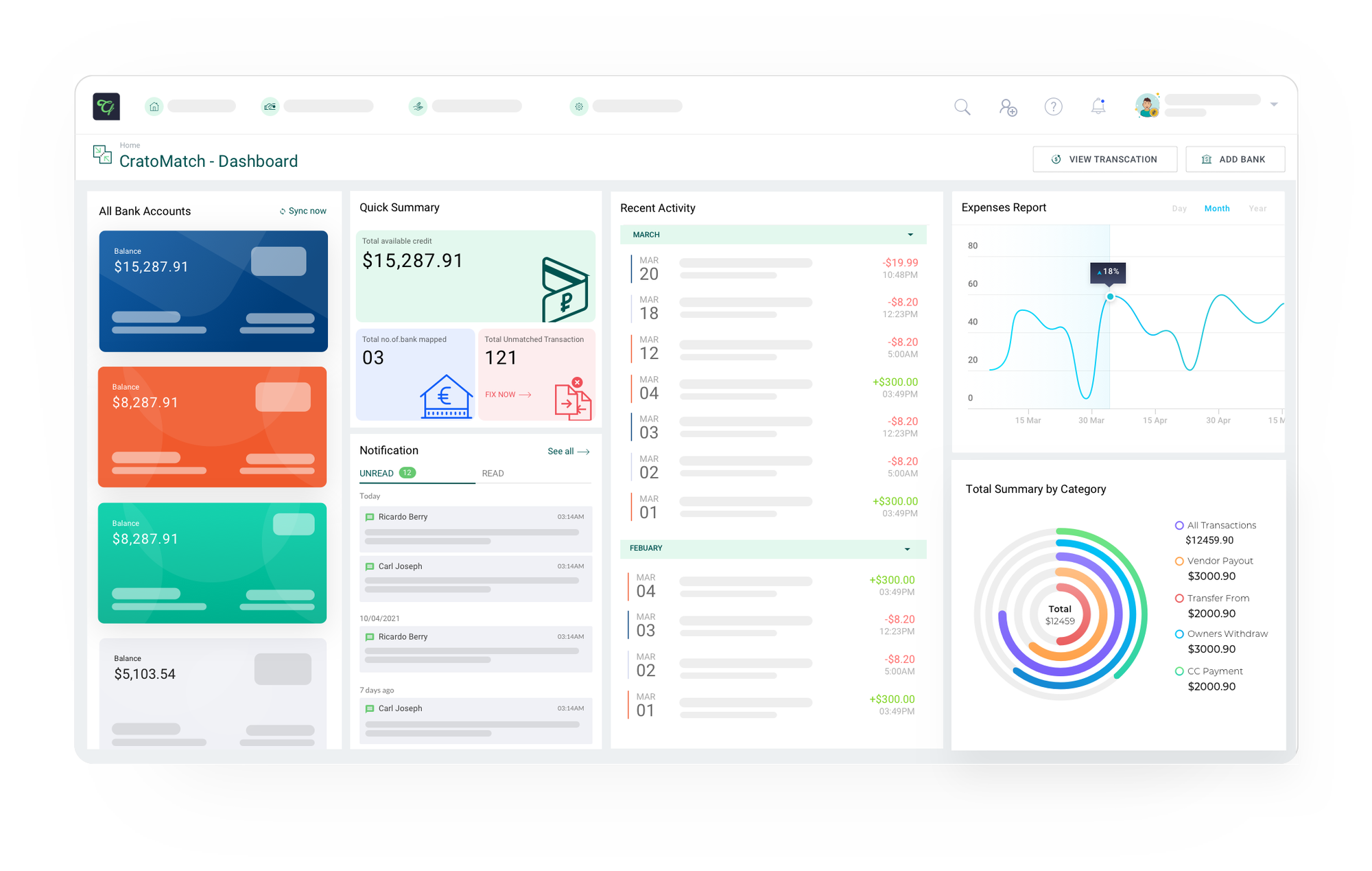

From the moment you see the dashboard, it’s clear Cratoflow gives you a complete picture of your business’s finances.

You can see all of your transactions, invoices, and payments in one place, any time you want, for total financial transparency.

Plus, Cratoflow automatically tracks sales and expenditures for real-time cash flow projections—perfect for small businesses that need to know exactly where their finances stand.

The colorful Cratoflow dashboard lets you see the status of all your accounts at a glance!

Getting a hold on your business finances shouldn’t feel like you’re trying to take three tigers on a walk. ("Joe Exotic and I have very different definitions of the word 'pet.'")

Cratoflow makes it simple to keep track of daily transactions, set up automated billing, and get an accurate at-a-glance picture of your business’s financial health.

Own your business finances from start to finish.

Get lifetime access to Cratoflow today!

Plans & features

Deal terms & conditions

- Lifetime access to Cratoflow

- All future GrowthBot Plan updates

- No codes, no stacking—just choose the plan that’s right for you

- You must activate your license within 60 days of purchase

- Ability to upgrade or downgrade between 3 license tiers

- Only for new Cratoflow users who do not have existing accounts

- Note: Available for US customers with limited Canadian capabilities - see partner's pinned post below for details

60 day money-back guarantee. Try it out for 2 months to make sure it's right for you!

Features included in all plans

- Managed integrations

- Custom invoices

- Automated vendor bill processing

- Bank reconciliations

- Build and manage disputes

- Withdrawal and deposit categorization

- Inventory

- Sales order management

- Sales entry posting

- Product catalog

- Line-item invoice recognition

- AI-enabled data capturing

- Automated coding of expenses

- Advanced reporting

- Electronic submissions

- Get sales details from POS

- Manage deposits and withdrawals