FlyFin

Find every possible tax-saving deduction with an AI-powered tax filing app

Filing your taxes as a freelancer can make tax season feel more like spooky season ( …with the IRS as the creepy guy with the chainsaw harshing all the vibes).

Even if you’re saving every receipt and double-checking the math, you’re probably still overpaying, or worse, incurring penalties from the IRS.

What if there was a tool that could automatically detect every possible tax write-off and help you file with CPAs available 24/7—right from your phone?

Introducing FlyFin.

TL;DR

At-a-glance

Alternative to

Overview

FlyFin is a mobile app that finds every tax deduction on your return using an AI-powered tax engine and on-demand CPAs.

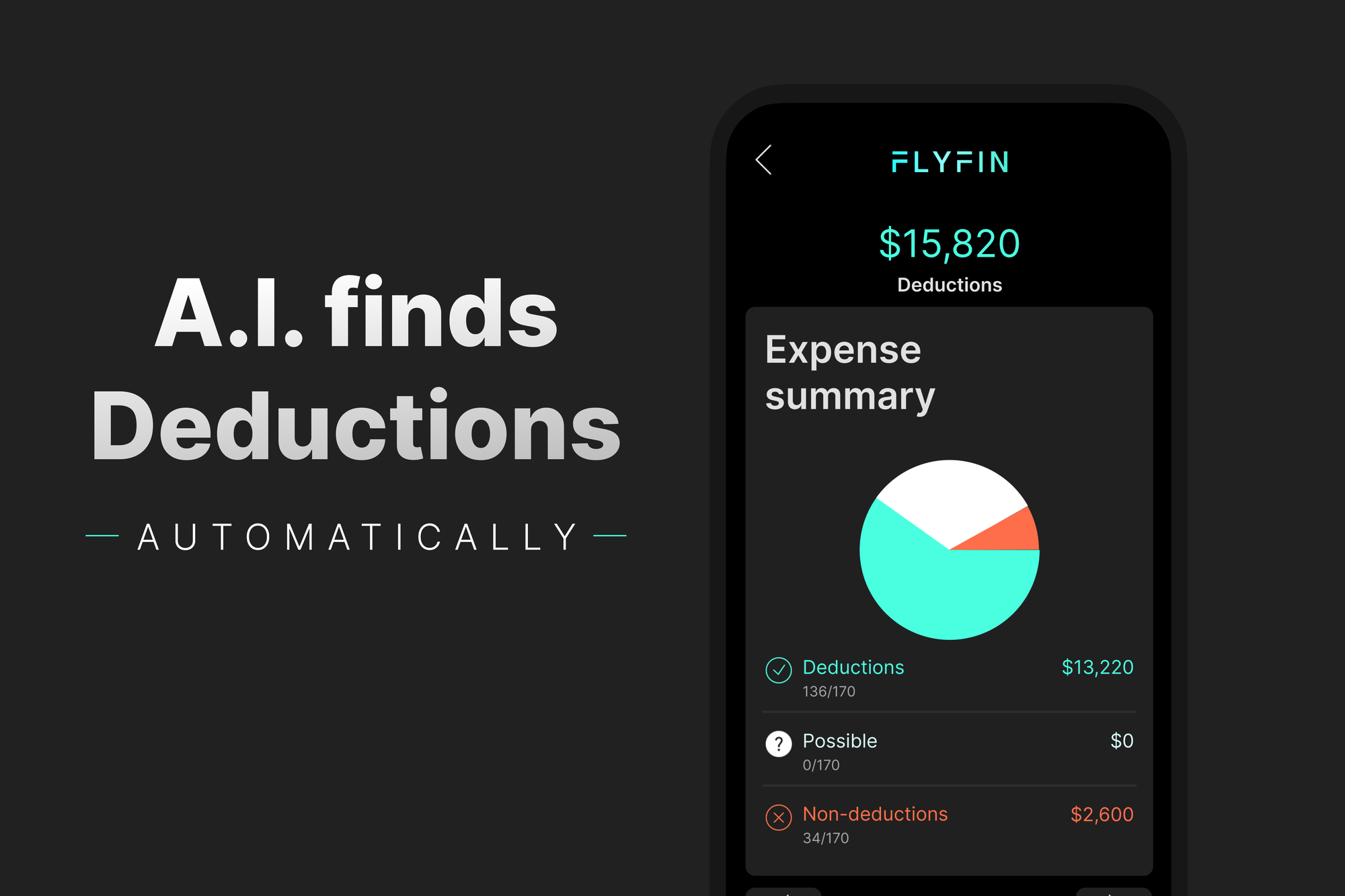

FlyFin’s mobile app automatically finds every possible tax deduction, so you’re not sifting through receipts and spreadsheets by hand.

To get started, you just need to link your account statements with Plaid—a secure platform designed for maximum privacy that can encrypt your financial data.

Then the AI-powered tax engine will analyze your expenses based on 124 business and personal deduction categories.

FlyFin lets you accept or deduct expenses as you go! Plus, you can track deductible expenses and taxes owed with monthly summaries.

Use this AI-powered tax engine to find every possible tax deduction in minutes!

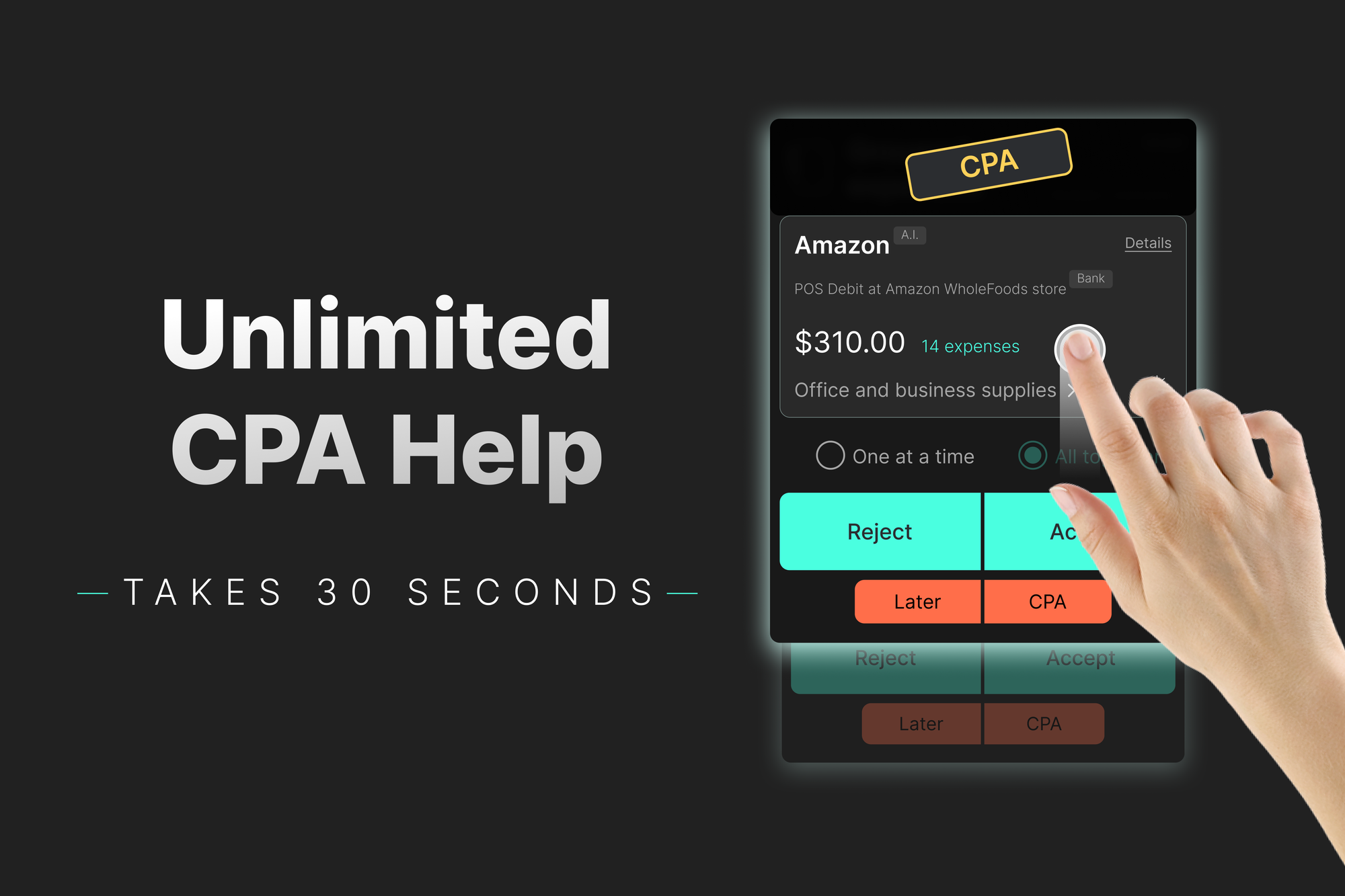

You can also ask a certified public accountant (CPA) for help! Just swipe up to type a question or schedule a call right from the app and get in touch with an expert within 24 hours.

Work with CPAs who are certified in state and federal laws, so that your taxes are always filed with accuracy.

But that’s not even the half of it! You’ll get tax calculators, income and expense trackers, and tax reports when you sign up for FlyFin.

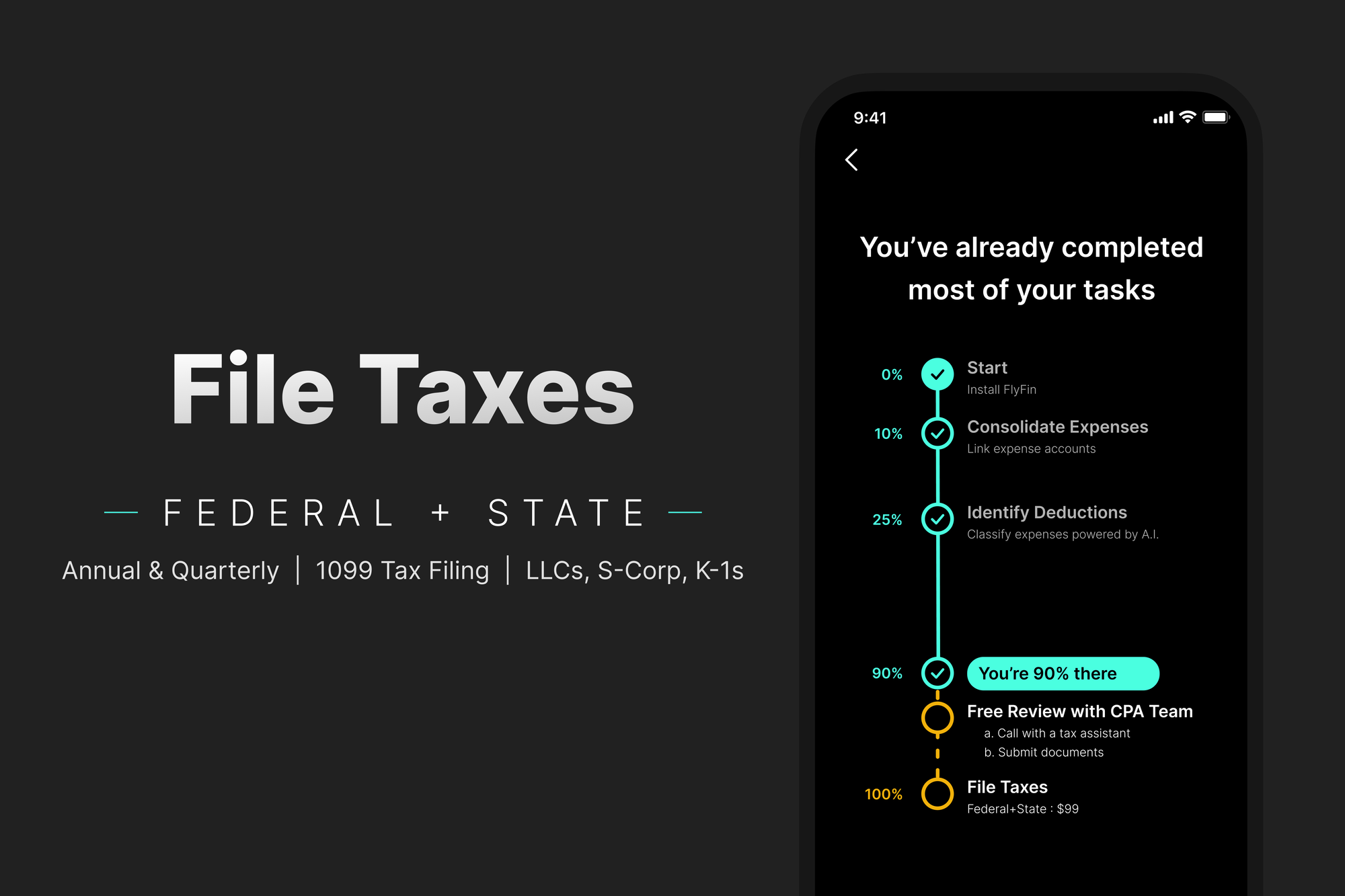

FlyFin’s app lets you work with a CPA to file your state and federal taxes.

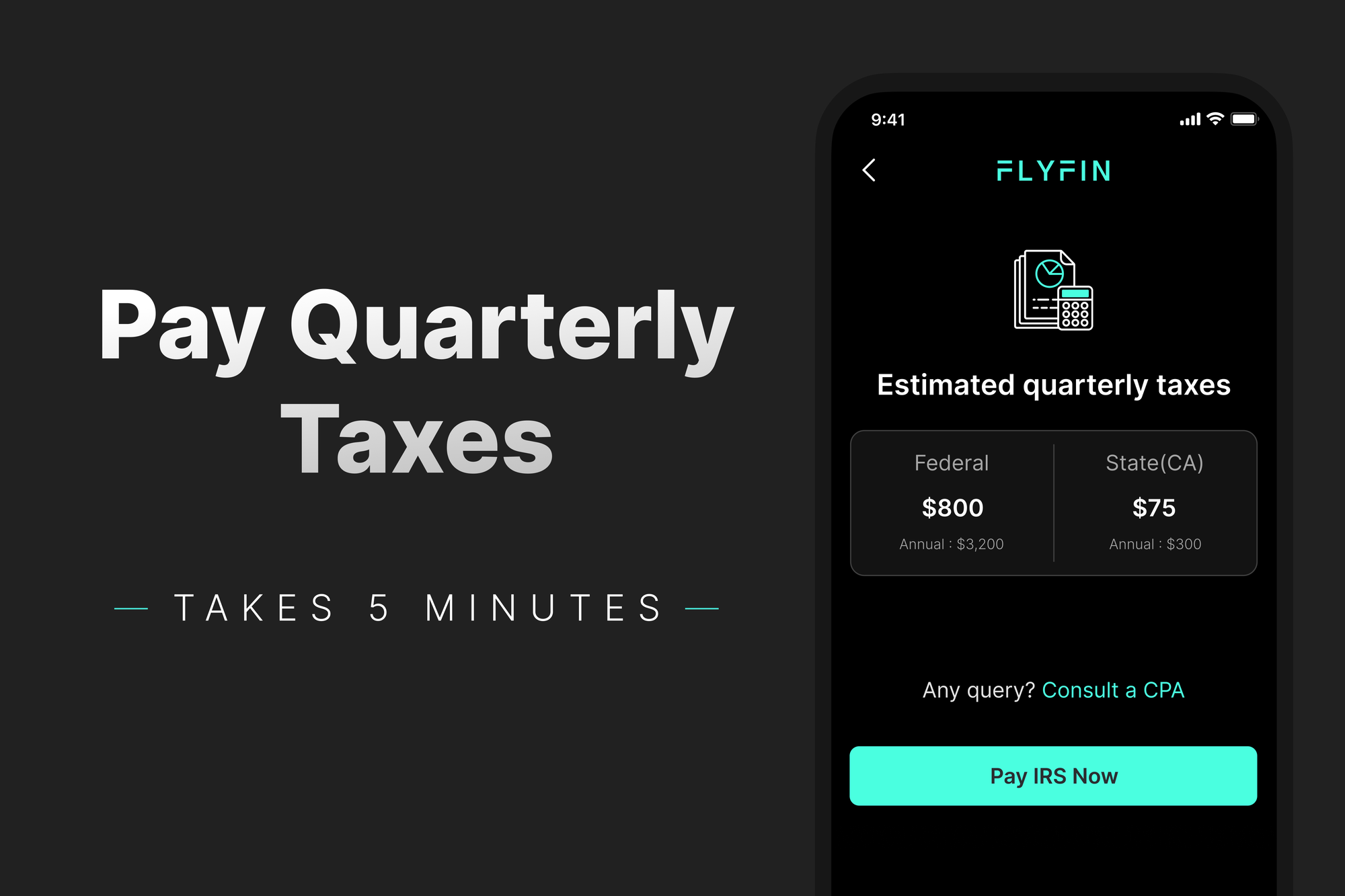

Calculate your estimated quarterly tax payments based on your income and deductions, thanks to FlyFin’s quarterly tax calculator.

This powerful tool finds deductions for your home office, internet, phone bills, office supplies, and even courses related to career development.

And you'll never miss a payment on quarterly taxes, because the app will send notifications for fast-approaching deadlines.

Pay your estimated quarterly tax payments straight from the FlyFin app.

FlyFin makes it super easy to file taxes for self-employed individuals, W-2 employees, LLCs, S Corps, and K-1s.

Best of all, your personal information isn’t stored on the platform or anywhere else—that includes account numbers, usernames, and passwords.

That’s because FlyFin is CCPA (California Consumer Privacy Act) compliant, which means your private details are perfectly safe.

Allows self-employed individuals to file annual, quarterly, and 1099 tax returns generated just for them.

Finding every possible tax deduction shouldn’t require Sherlock Holmes levels of detective work. (“I’ve got a hunch that I can’t claim this box of cigars as a business expense.”)

That’s why FlyFin helps you take advantage of every relevant tax deduction out there, so you’re able to maximize your savings.

Complete your tax return in a snap.

Get access to FlyFin today!

Plans & features

Deal terms & conditions

- 1 year of FREE access to FlyFin

- 1 year of Exclusive Plan updates

- You must redeem your code(s) within 60 days of purchase

- Please note: this deal is not stackable

- Only for new FlyFin users who do not have existing accounts

- Optional add-on: Get your 1040 individual tax filing for additional $156

- Optional add-on: Get your 1040 individual tax filing plus one S Corp/LLC tax filing for $276

- Above add-ons include a one-on-one CPA call

- Important Note: This deal is for US based businesses only

Get 1 year of access. Simply redeem the product within 60 days.