Mint

Take charge of your financial life

Mint is a personal finance app that helps you manage your expenses, budgets, income, investments, and more in one place.

No one wants to spend more money than they can afford. Mint is the financial sidekick you need for motivation to pay off debt, stick to your budget, and plan for the future.

Connect all your accounts to get a complete view of your money. Mint stores your bank accounts, budget, bills, and investment in a single app, helping you stay on top of all your finances with ease.

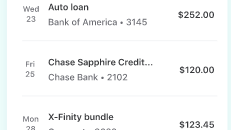

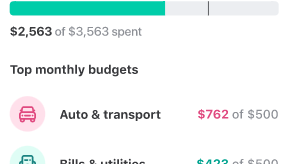

Quickly view your cashflow to see how much of your money is going in and out. Set your spending limits and receive notifications before exceeding your budget.

Spot opportunities to cut your expenses and save for the vacation you’ve been dreaming of. You can create unlimited categories to track savings for what you love. The latest iPhone, anniversary gift, a software tool, whatever it is, Mint can help plan for that.

One cool feature is its bill negotiation service, Billshark. Let experts negotiate your rates down and save on monthly bills.

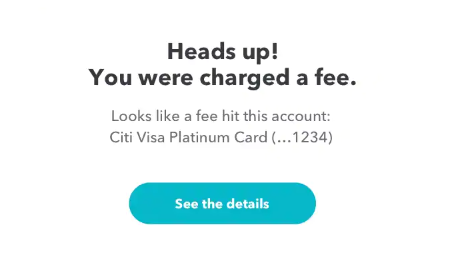

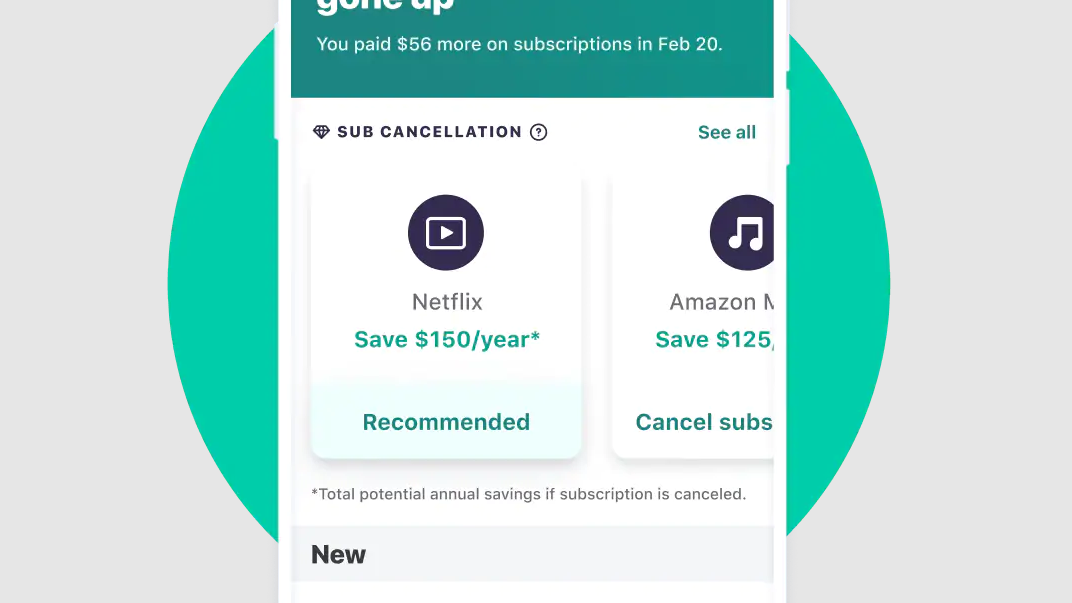

Mint notifies you of ATM fees, approaching payments, and unusual transactions. It also alerts you to increases in your subscription costs. That way, you can easily identify the recurring plans you don’t need, cancel them, save more, and remain in full control of your money.

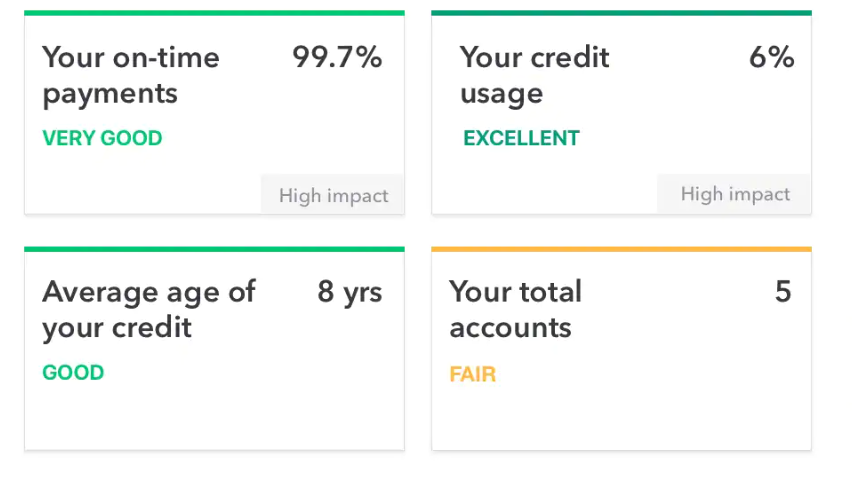

Calculate your credit score directly on the app. Mint breaks down your credit usage and offers recommendations on improving your score.

Get a comprehensive view of your purchases. Mint separates purchases from one transaction into different categories. Shopping for groceries and a last-minute birthday gift? The app will put them in the right category automatically.

Track your investment portfolio and identify unnecessary fees from advisors and brokerages. See your asset allocation spread across all your investment accounts. Mint also provides personalized insights based on your net worth, expenses, and budgets.

With this robust app, it’s now easier to take back control of your financial life.

Key features

- Bill tracking to stay on top of expenses

- Subscription management to identify cost increases

- Bill negotiation to reduce rate and save on monthly bills

- Budgeting across multiple categories

- Free credit score within app

- Investments portfolio across accounts

- Personalized insights on wealth building

- Alerts for incoming bills, suspicious payments, and more

TL;DR

At-a-glance

Best for

Overview

Plans & features

Deal terms & conditions

- Digital download of Mint

- Yours forever if you download and save within 60 days of purchase

- This deal is non-refundable